49+ do i have to itemize to deduct mortgage interest

Generally income taxes that were paid to a foreign country can be taken as an itemized deduction on Schedule A or. So if each person paid 50 of the mortgage each person is only eligible.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Ad TaxAct has a deduction maximizer to find money hiding everywhere.

. Web When you own a home and make mortgage payments its sometimes beneficial to itemize because the total deductible amount may exceed the standard deduction. You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040. Web To be able to deduct mortgage interest you must be qualified to itemize.

Ad Filing Taxes Is Fast And Easy With TurboTax Free Edition. Web The answer is that you can only claim the deduction for the interest you actually paid. Web If you want to deduct your mortgage interest youll have to itemize.

Web You may be able to reduce your tax by itemizing deductions on Schedule A Form 1040 Itemized Deductions. Web In general your New York itemized deductions are computed using the federal rules as they existed prior to the changes made to the Internal Revenue Code. Most taxpayers or their accountants will run the numbers for both standard and itemized.

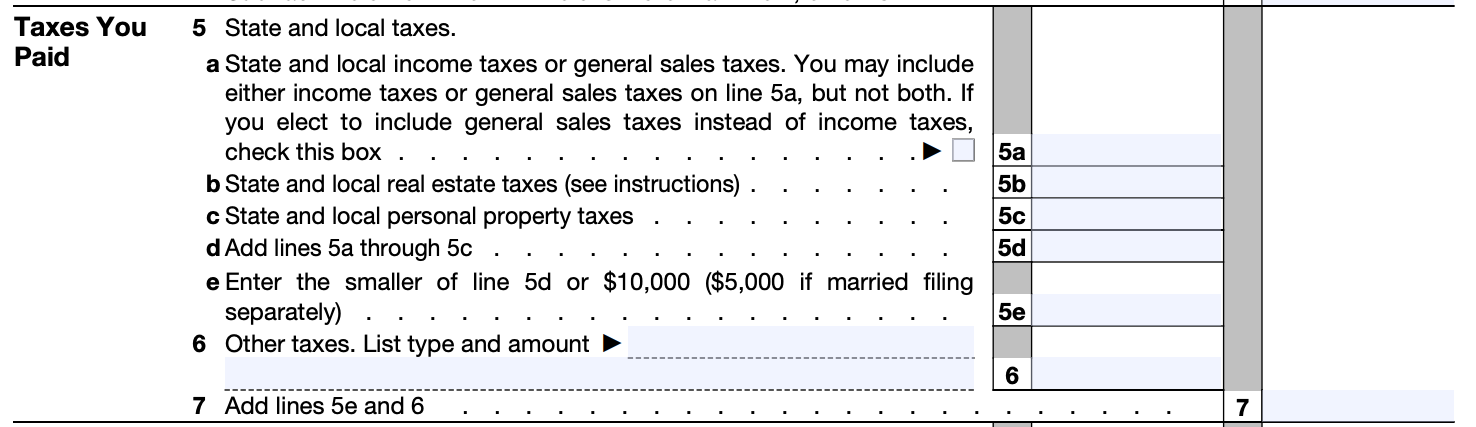

File With Confidence Today. Web Itemized deductions for 2022 include Mortgage Interest State and Local taxes up to 10000 including property taxes medical expenses in excess of 75 of your. Answer Simple Questions About Your Life And We Do The Rest.

Web The amounts received are considered loan advances not income and are not taxable. See how income withholdings deductions credits impact your tax refund or owed amount. This means the total of your itemized deductions exceed the standard deduction for your filing status.

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Itemized deductions include amounts you paid for. Web You cant deduct home mortgage interest unless the following conditions are met.

Web Before you deduct your mortgage interest from your taxes you will need to pick between itemized deduction and standard deduction. Web deducted as an itemized deduction. See If You Qualify Today.

The loan comes due depending on the plan when the loan period ends the. Web To answer the specifics of your question you will report student loan interest HSA interest income and dividend income whether you are itemizing deductions or.

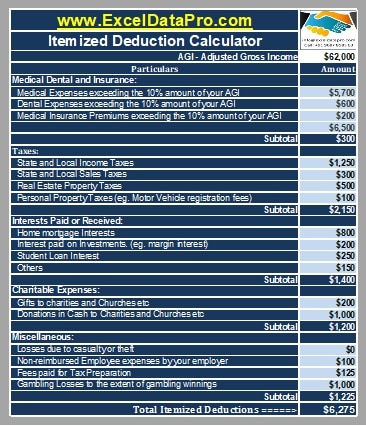

Download Itemized Deductions Calculator Excel Template Exceldatapro

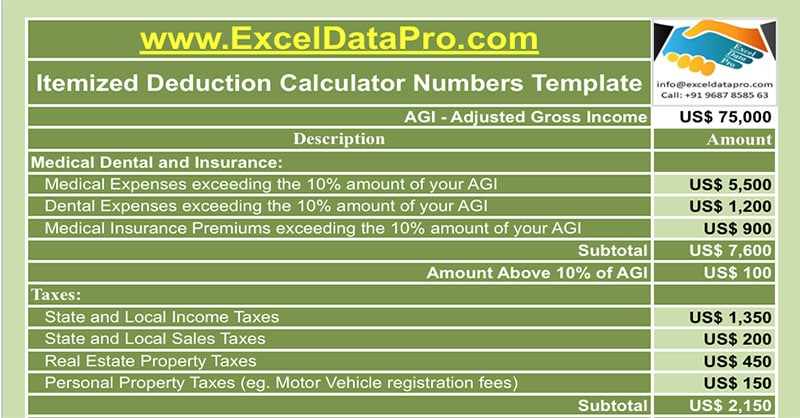

Download Itemized Deduction Calculator Apple Numbers Template Exceldatapro

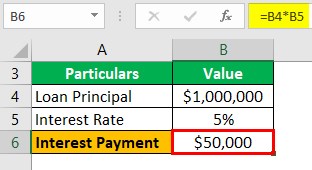

Mortgage Interest Deduction How It Calculate Tax Savings

Maximizing The Investment Interest Deduction

Investment Expenses What S Tax Deductible Charles Schwab

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting

Mortgage Interest Deduction Who Gets It Wsj

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Ultimate List Of Itemized Deductions For The 2022 Tax Year The Dough Roller

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

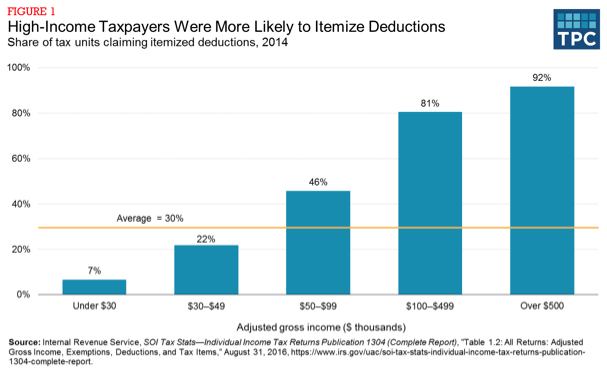

Itemized Deductions Full Report Tax Policy Center

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

3 Itemized Deduction Changes With Tax Reform H R Block

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

What Is The Standard Deduction

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File